Our Portfolio reflects our vision and articulates our Realtech strategy.

Key Data

431mio

Gross Real Estate Asset Value (GREAV)

13

Assets in Portfolio

5%

Targeted Return

25mio

Total Rent Roll (CHF)

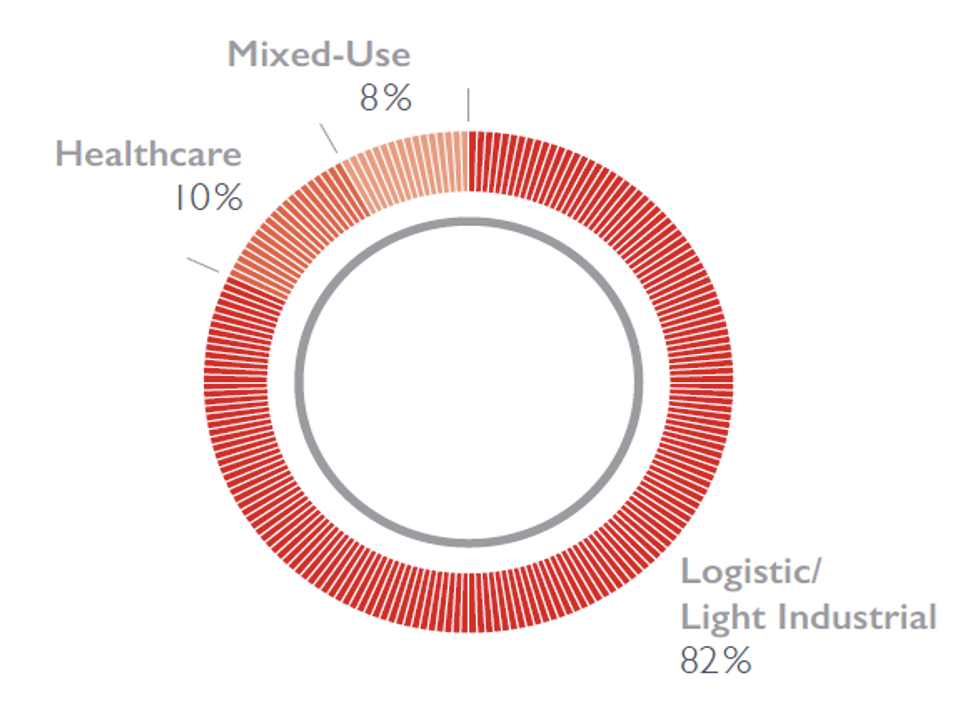

Sectors

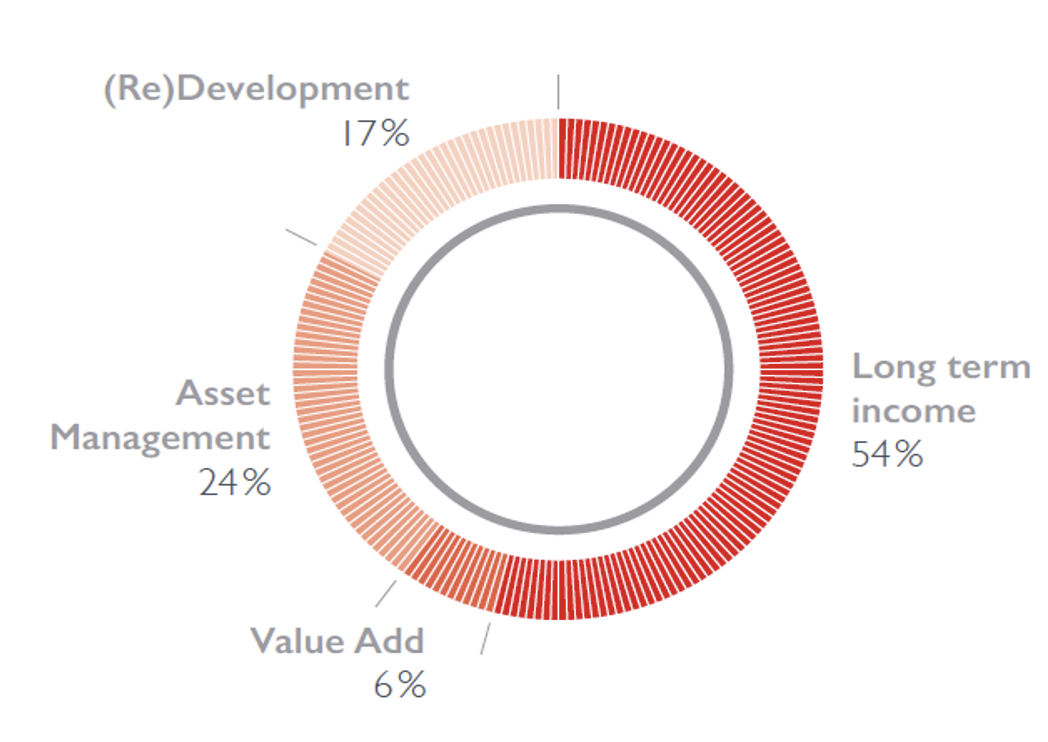

Strategies

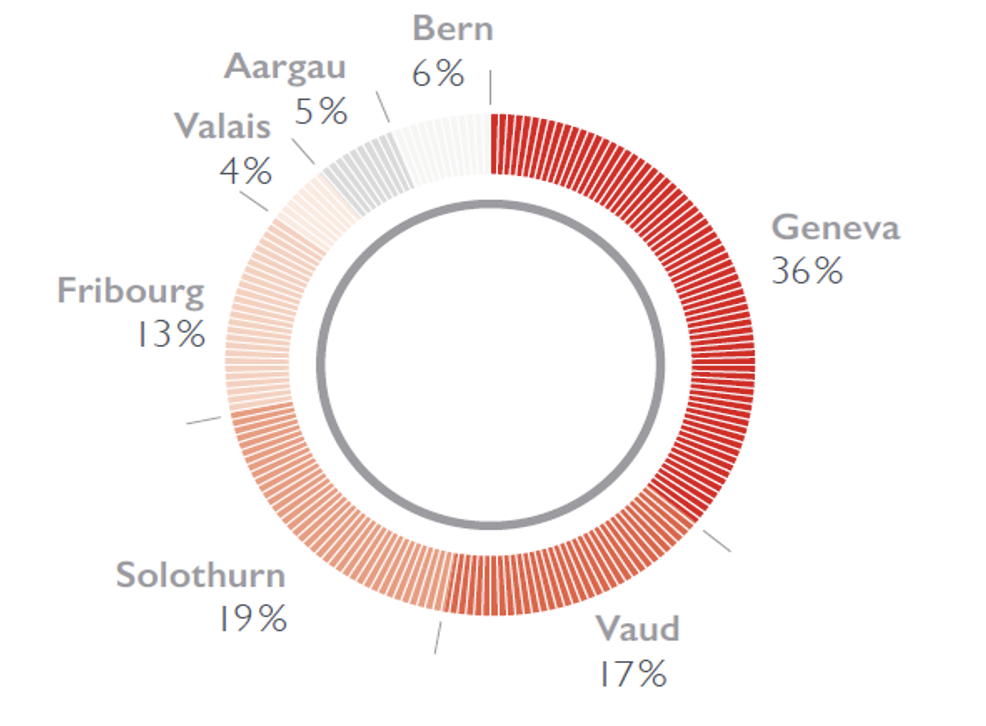

Locations

Sector Weighting

VSRP aims to build a diversified portfolio of Swiss commercial assets and mainly invests in Realtech sectors

with a focus on logistics (82%) and healthcare (10%). It also considers mixed used (8%).

Our portfolio benefits from strong tenants active in stable and high-growth industries

Logistics

80%

Rent Roll

79

Tenants

352 mio

AuM (CHF)

170’000 m²

Surface

Healthcare

10%

Rent Roll

2

Tenants

45 mio

AuM (CHF)

5’600 m²

Surface

Mixed use

10%

Rent Roll

32

Tenants

34.5 mio

AuM (CHF)

12’400 m²

Surface